What National Employment Trends Show About Foxconn Job Prospects In Wisconsin

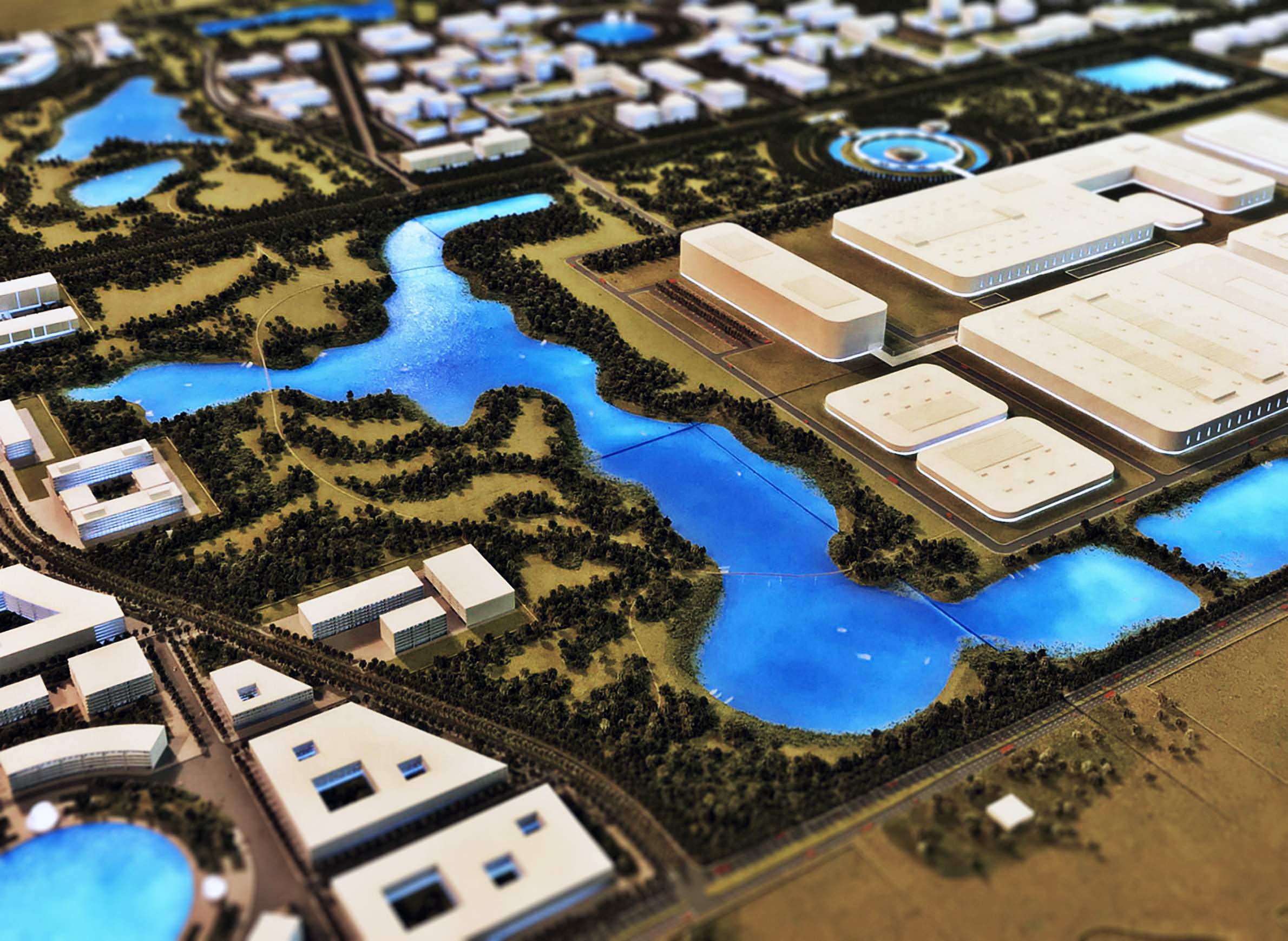

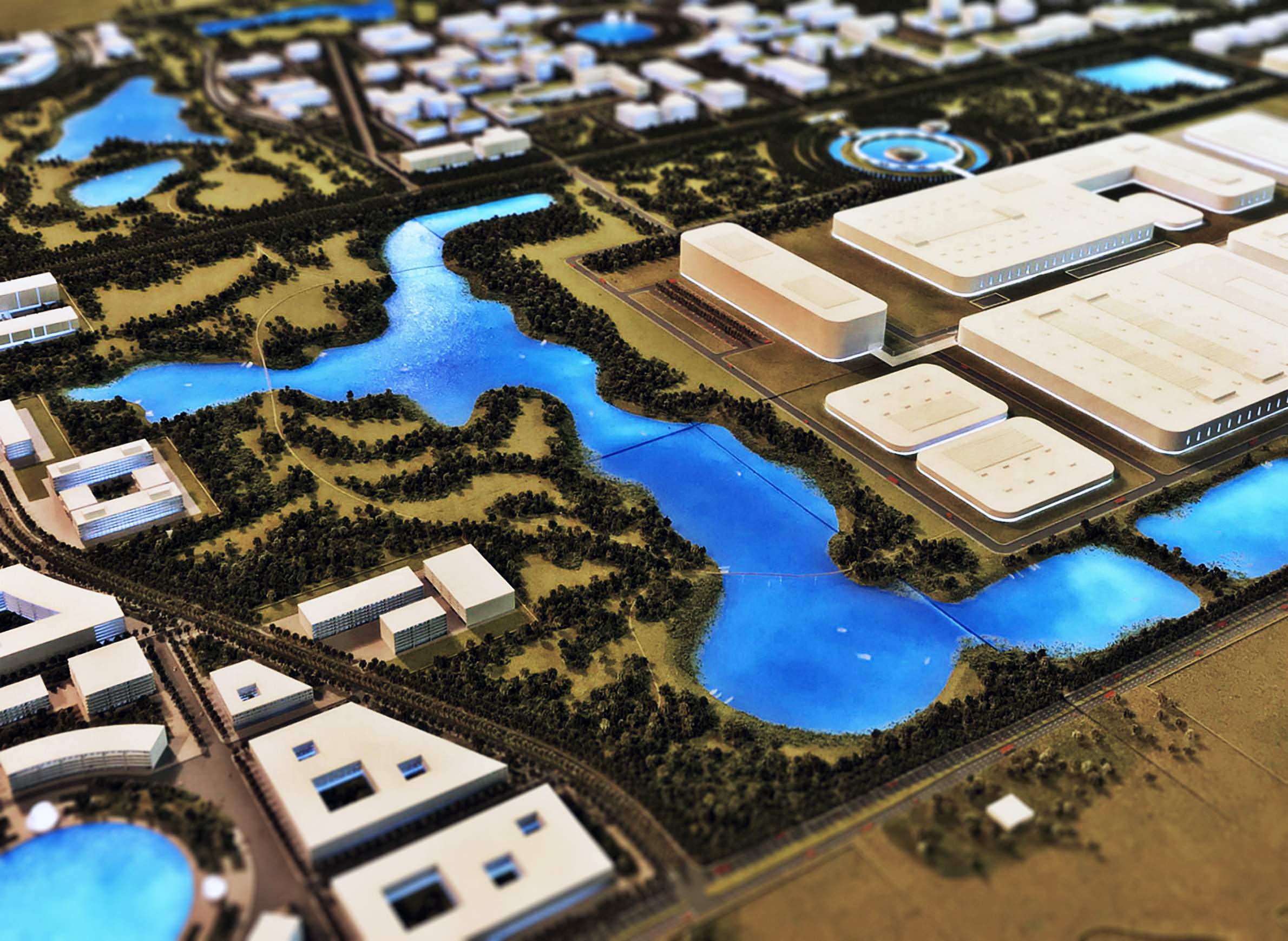

When electronic component manufacturer Foxconn Technology Group announced its intention to build a $10 billion manufacturing campus in southeastern Wisconsin in the summer of 2017, the magnitude of the move was met with intense excitement and uncertainty. The facility initially expected to employ 3,000 workers, with a potential to expand up to 13,000 employees.

But questions surround the types of jobs this type of work requires: What levels of educational attainment or skills are needed? What are typical wages for these types of occupations? Are these jobs susceptible to replacement through automation or computerization?

While only Foxconn will determine the ultimate characteristics of its jobs, examining occupational and employment trends for a portion of the broader electronic component manufacturing industry in the United States may offer additional insight.

Job trends in electronics manufacturing

The July 2017 memorandum of understanding between the state of Wisconsin and Foxconn states that the new facility will manufacture thin-film-transistor liquid crystal displays like those found in cell phones and other small devices. Although this factory in Mount Pleasant would be the first of its kind in the United States, the North American Industry Classification System categorizes this type of manufacturing as part of the larger Semiconductor and Other Electronic Component Manufacturing industry (NAICS 3344), which includes a variety of products like electrical connectors, microprocessors and printed circuit boards.

It is unlikely that Foxconn will neatly fit into the NAICS 3344 industry classification. However, national occupational and employment trends in this industry provide some perspective on representative employment in advanced electronics manufacturing operations. As the industry also produces products that may be used as components in the LCD panel manufacturing process, occupational information for this industry may also reflect employment in a portion of the facility’s supply chain.

The Semiconductor and Other Electronic Component Manufacturing industry accounts for almost 370,000 employees in the United States. While nearly every state is home to some establishments in this industry, employment is heavily concentrated in a few areas. Wisconsin currently ranks 15th among all states in terms of total employment.

Within broad occupational categories at the national level, production jobs account for the greatest share (37.6 percent) of employment in the electronic component industry. Production occupations include assemblers, fabricators, industrial machinery operators, batchmakers, welders and a variety of other populations.

This percentage differs significantly from the overall manufacturing sector (NAICS 31-33) where production work makes up 51.6 percent of all employment. In contrast, architecture and engineering occupations account for almost 26 percent of the electronic component industry’s national employment compared to just 6.5 percent in the overall manufacturing sector. Most of the employment in the architecture and engineering occupations is related to the latter.

In fact, the Semiconductor and Other Electronic Component Manufacturing industry has the highest share of employment classified as architecture and engineering occupations among the 86 manufacturing categories in the classification system.

A July 2017 economic impact study performed by EY for the Foxconn facility suggests that it will have a reliance on engineering and business occupations, mirroring national trends in the broader industry.

Assuming the Foxconn project reaches its originally promoted employment of 13,000 workers, the economic impact analysis notes that 1,600 would be process equipment engineers, 820 would provide business support, 463 would be integration engineers and 300 would be computer integrated manufacturing engineers. The remaining 9,817 employees are classified as hourly operators and techs performing tasks and requiring skills to be determined by Foxconn.

However, as the Foxconn facility adapts to changes in the market, it is likely that the occupational requirements will change as well.

Because the electronic component manufacturing industry includes more than 175 detailed job categories, employees classified as hourly operators and techs could be a mix of many different occupations. However, the 25 most common occupations in the category account for almost 68 percent of the industry's total employment. In addition to engineers, many of these occupations are classified as assemblers, electronics and engineering technicians, managers, software developers, purchasing agents and sales representatives.

The national occupational structure for this industry suggests that it has a notable concentration of occupations that usually require higher levels of education and skills. Specifically, it relies on computer, engineering, management, financial, and other business-oriented occupations, all of which tend to require at least an associate's degree.

The U.S. Department of Labor's Occupational Information Network provides data on “Job Zones” that aids in further estimates of the general educational attainment needs for an industry. Called O*NET, it classifies occupations according to their required levels of knowledge, skills and abilities. Using this information, O*NET also assigns a Job Zone to each occupation based on preparation typically required, as well as the average length of time workers need to acquire information, learn techniques and develop the capacity needed for average performance.

Occupations in Job Zone 1 tend to have lower preparation and skills requirements while occupations in Job Zone 5 require the largest amounts of education and preparation. With 40 percent of total employment in Semiconductor and Other Electronic Component Manufacturing, occupations in Job Zone 2 account for the greatest share of workers. However, the combined share of employment found in Job Zone 4 and Job Zone 5, or jobs that typically require a bachelor’s degree or higher, are responsible for 41 percent of employment. Occupations in Job Zone 3 also account for one in five jobs.

When compared nationally to all 86 North American Industry Classification System categories, electronic components manufacturing ranks 10th highest in the total share of employment found in the combined Job Zones of 3, 4 and 5. The concentration of occupations in these job zones suggests that 61 percent of employees require either vocational training, an associate's degree, a bachelor's degree or an advanced degree.

Furthermore, most of the manufacturing categories that rank in the top 10 for these combined job zones are found in the broader computer and electronic manufacturing subsector (NAICS 334). Consequently, this broader industry has some of the highest educational requirements among all manufacturing categories.

Wage trends in electronics manufacturing

The Foxconn facility is expected to provide an annual average wage of $53,875. As with any industry, annual mean wages can be influenced by the distribution of wages among individual employees. That is, extreme values at the high or low end of the wage scale can either inflate or depress the overall average wage.

While Foxconn will determine its final wages based on its needs and regional labor market conditions, the national distribution of annual average wages for occupations in the Semiconductor and Other Electronic Component Manufacturing category provides some perspective on the wage patterns within the advanced electrical equipment manufacturing industry.

The national distribution of employment by annual average wages suggests that the electronic component manufacturing industry is skewed toward occupations with higher annual average wages. Approximately 56 percent of employment in the industry has an annual average wage above $55,000. In contrast, just 28 percent of jobs in the overall manufacturing sector had annual average wages above $55,000.

Only 27 percent of employees in the electronic component manufacturing industry have annual average wages below $35,000, compared to 37 percent in the broader manufacturing sector. Certainly wages for individual employees within these wage ranges may vary, but the industry’s high wage structure does not appear to be influenced by a relatively small number of extraordinarily high earners. Specifically, 28 percent of employment in the industry has an annual average wage above $100,000.

Employment decline in electronics manufacturing

Much like employment in the overall manufacturing sector, employment levels in the Semiconductor and Other Electronic Component Manufacturing industry have declined significantly since the early 2000s. Although these changes can be attributed to several factors, national employment in the manufacturing sector dropped by almost 29 percent between 2000 and 2016. The decline in electronic component manufacturing employment was even greater at 46 percent.

Despite these changes, output in the industry continued to increase dramatically between 1990 and 2008. In fact, the increase in output and productivity in this category (and other computer and electronics manufacturing categories) was a primary factor in the manufacturing sector's overall national productivity performance over the past several decades. Without the productivity growth in the computer and electronics manufacturing industry, national GDP growth in the overall manufacturing sector would have been somewhat stagnant.

National employment change in the Semiconductor and Other Electronic Component Manufacturing industry has not been consistent across occupational categories. Of the more than 127,000 jobs lost between 2002 and 2016, over 81,000 jobs were in the production occupational category. Another 14,000 jobs were lost in office and administrative support occupations. These two categories alone were responsible for almost 75 percent of the employment decline in the industry. Not surprisingly, these occupational categories tend to require lower levels of education and preparation.

Occupational categories often requiring higher levels of education — including engineering, computers and management — also declined over this period. However, these losses occurred at lesser rates.

Perhaps one of the biggest questions surrounding these employment changes is whether job losses and productivity increases can be attributed to automation and whether future job losses are likely to continue as a result.

Susceptibility to automation in electronics manufacturing

A 2014 analysis suggests that productivity increases in the computer and electronics manufacturing industry are largely due to quality improvements and falling prices for computers and semiconductors. Accordingly, the high growth in productivity and quality can be attributed to improvements stemming from research and development rather than increased automation. The analysis also found that productivity resulting from improved product design and production processes do not directly cause job losses.

Many of these job losses can be attributed to a shift in production to lower wage nations in Asia, but this does not mean that the industry has not experienced automation. In fact, the domestic computer and electronics component industry has had high levels of automation for several decades.

But longstanding automation in the industry does not mean that current or future employment is no longer susceptible to replacement through technology. The computerization or automation of occupations will depend on many factors, including labor availability, capital and labor costs, technological advances, regulatory issues and the desires of ownership. Consequently, it is difficult to forecast which occupations may be susceptible to automation in either the near term or more distant future.

In general, occupations with a high probability of computerization and automation are more likely to involve routine tasks and less likely to require creative or social functions. Many of these occupations are also less likely to require higher levels of education. While numerous occupations in both the overall manufacturing sector and the electronic components manufacturing industry are at risk for automation at some point, there is no way of knowing how many jobs will become automated, particularly given already high levels of automation.

While advances in automation are likely to occur, the process may still face hurdles. Additionally, many employees may not be easily separated from the equipment or technology that allows full automation.

Questions remain about Foxconn jobs

The specific labor force needs of Foxconn will ultimately dictate the type of skills and education levels required by its employees. These skills and educational requirements, combined with regional labor market conditions, will also influence the wages paid to employees. While national data may provide perspective on potential occupational and employment figures, Foxconn's needs for its new manufacturing facility may differ significantly.

However, it is likely that analysis of the national Semiconductor and Other Electronic Component Manufacturing industry captures some characteristics of the Foxconn facility and its potential supply chain.

When compared to the overall manufacturing sector, the nation's electronic component manufacturing industry tends to have a disproportionately high share of employment in engineering occupations, a larger share of occupations that require a college degree, a higher share of employment with annual average wages above $55,000 and a lower share of employment with annual wages below $35,000 and a somewhat lower share of occupations with a high probability of automation or computerization.

In all, this suggests that industry embodies many characteristics often attributed to advanced manufacturing. But many important questions still remain, including unknowns in terms of automation susceptibility and Wisconsin's capacity to produce or attract the specific types and numbers of employees needed.

This item was originally published as part of the University of Wisconsin-Extension Center for Community and Economic Development's WIndicators series of economic reports.

Matthew Kures is a community development specialist at the UW-Extension Center for Community and Economic Development.