Escalating Trade War Sows Fears In Wisconsin's Agricultural Industry

It's a waiting game for Wisconsin farmers as they watch the market to see how a trading spat between the United States and China will affect prices for their products.

In March 2018, President Donald Trump announced a 25 percent tariff on steel imports and a 10 percent tariff on aluminium imports from all countries except Canada and Mexico. Numerous countries, including those in the European Union, also were excluded later.

Trump's actions were lauded by the U.S. steelworkers' union but sparked a back-and forth of retaliatory actions with China — sparking intense criticism from U.S. industry leaders and politicians.

U.S. Rep. Ron Kind, D-La Crosse, wrote an op-ed in the Tomah Journal criticizing the president's actions.

"Instead of supporting growth in our farms by opening new markets and making a push for more exports, the president is creating trade policies that do more harm than good," Kind wrote on March 26.

"This short-sighted decision will raise the cost of farm equipment, eliminate jobs and be the grounds for retaliation by the trading partners we rely on…," he added.

On May 29, Trump announced that the U.S. would indeed be imposing tariffs on imports from China. One day later, the president announced it would impose tariffs on steel and aluminum imports from the EU, Canada and Mexico, which in turn prompted declarations of retaliation from each.

Both rounds of actions did trigger retaliation, but the full effects of escalating threats between the U.S. and China can’t be measured yet. Economists agree, however, that if China’s threatened tariffs come into effect they will have a negative, fairly immediate, impact on the U.S. agriculture industry.

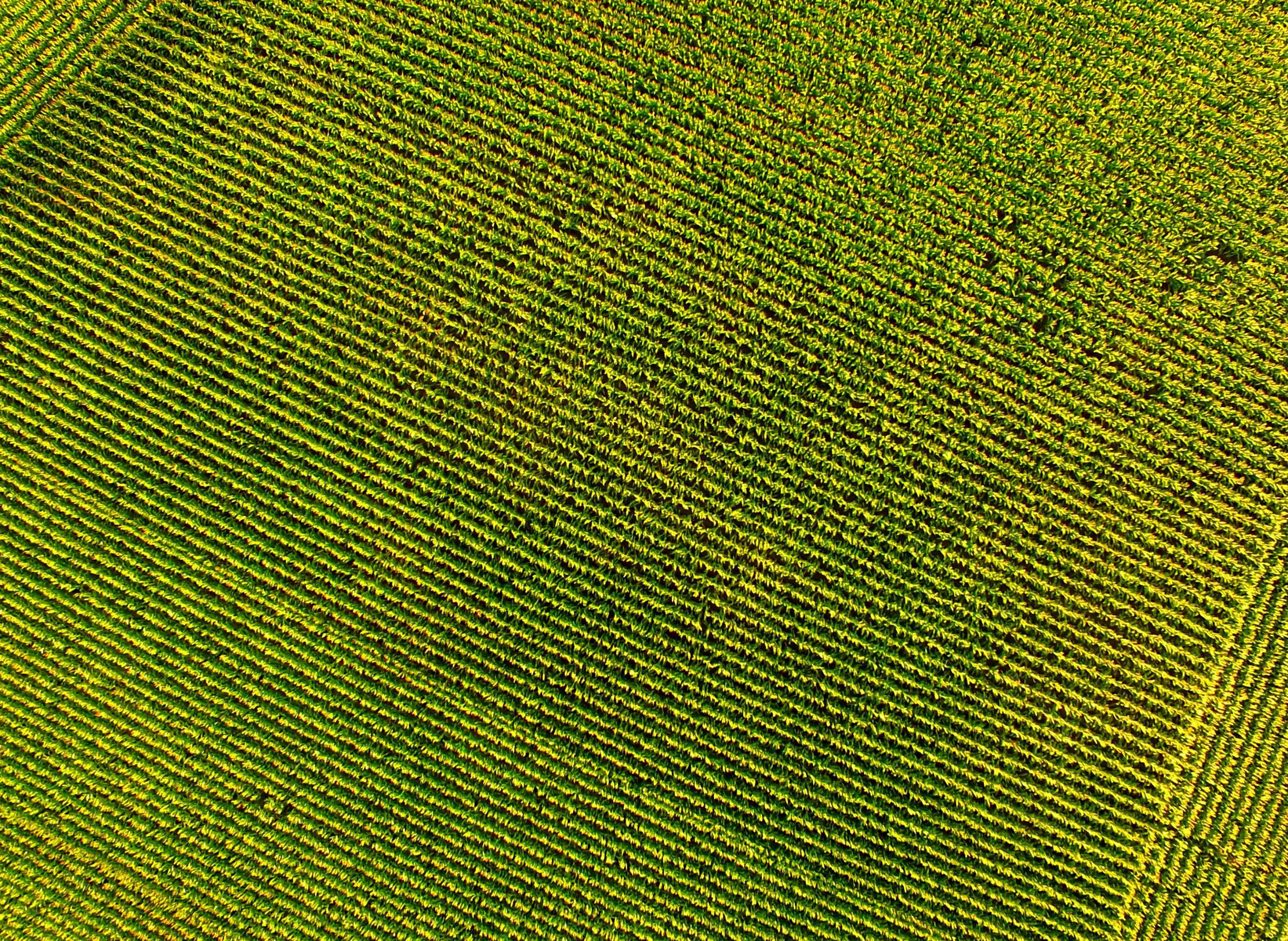

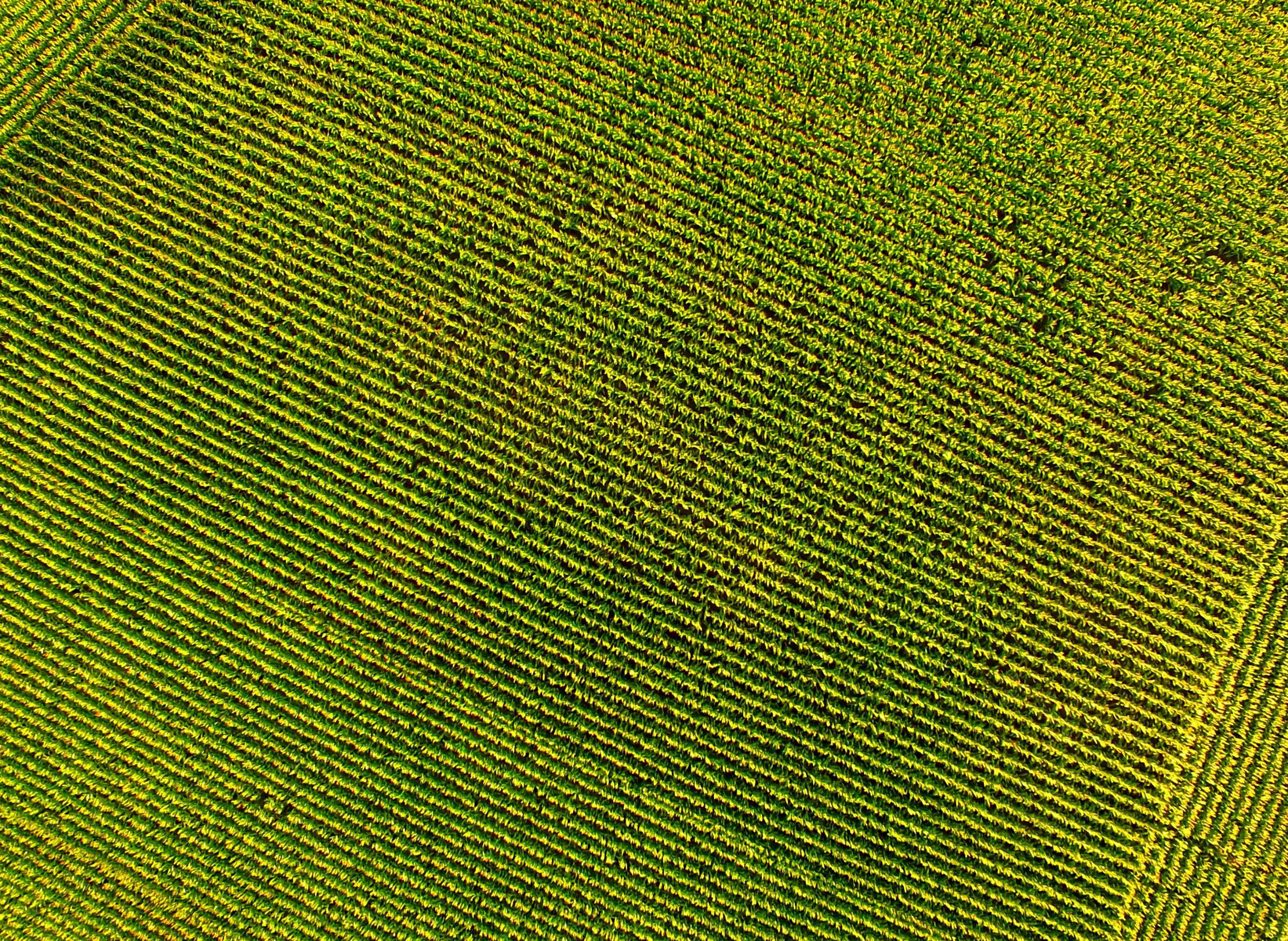

In Wisconsin it could significantly impact exports of ginseng, cranberries and soybeans.

Tit-for-tat trade dispute escalates quickly

Steel and aluminum were not the only goods the United States has threatened to slap with tariffs. On March 22, Trump instructed the U.S Trade Representative to put together a list of additional product tariffs against China and to pursue dispute settlement in the World Trade Organization regarding technology licensing practices.

In response, the Chinese Embassy released a statement saying it was "strongly disappointed" that the United States was "ignoring rational voices" and disregarding their mutually beneficial relationship. The country then imposed a 15 percent tariff on 120 U.S. products — including cranberries, of which Wisconsin is the nation's leading producer — and a 25 percent tariff on eight other products including pork. The tariffs affect more about $3 billion worth of U.S. goods, according to Quartz.

Both the original steel and aluminum tariffs and China's retaliatory list are in effect.

On April 3, the U.S. Trade Representative released a list of suggested tariffs on 1,300 Chinese goods, largely focused on technology, machinery and aerospace industries.

The next day, China announced another set of retaliatory tariffs on 106 U.S. products worth over $50 billion annually, according to CNBC. The list included soybeans, corn, dried cranberries and meat.

Then Trump doubled down, threatening an additional $100 billion in the tariffs the next day.

The U.S. tariffs could have gone into effect in early May. However, days before the deadline, the White House announced it would send a delegation to China to discuss the two countries' trade relationship.

China said its implementation date depends on what the United States decides to do, according to a Chinese news agency.

Retaliatory tariffs will hit farms hardest

Farms across the nation are already feeling squeezed. In the last five years, net farm income has dropped by 50 percent and many farm families have diversified, with at least one member earning a salary away from the farm, according to economists.

"We're very concerned about our bottom line all the way around," Veronica Nigh, an economist with the American Farm Bureau Federation told The Observatory.

Both the original U.S. steel and aluminum tariffs and China’s retaliatory tariffs will negatively impact farmers, experts said. But if China’s second set of tariffs go into effect, it will have a fairly immediate impact on Midwest farmers who grow a lot of corn and soybeans.

The United States exports 30 percent of soybeans it grows to China every year, roughly $14 billion worth, according to the Farm Bureau. Wisconsin exported more than $7.2 million in soybeans to China in 2017, according to the Richard Hummel, a communications specialist for the Wisconsin Department of Agriculture, Trade and Consumer Protection.

Additionally, the tariffs could also impact $11 million worth of cranberries, and $14 million in ginseng that the state exports to China.

However, products such as soybeans or No. 2 yellow corn are generic commodities — these products are grown around the world, said Brian Gould, an agricultural economics professor at University of Wisconsin-Madison. If those tariffs take effect, China will likely stop importing U.S. soybeans, Gould said, because with the tariffs, they will cost more than soybeans from other countries.

That's a problem for farmers.

The amount of soybeans and corn they have to sell in 2018 is already set because farms typically make planting decisions at the beginning of the calendar year. Without exporting to China, farmers will need to sell those products domestically — flooding the market.

That will cause market prices to drop, causing farmers to make less from this year’s crop — and any stored product, an asset, will lose value.

"You've lost dollars even though you haven't done anything," Gould said.

Even the threat of tariffs sent waves through the market. Nigh said soybean prices dropped 30 percent when the news broke. But she said prices recovered some when people realized they wouldn’t take effect immediately.

"[That] can kind of give you an idea of what's to come if those tariffs were to come into effect," Nigh said.

Even through the second round of tariffs haven’t been imposed yet, China's imports of U.S. soybeans have taken a dive, according to a report by the Wall Street Journal.

Chinese importers are holding off on purchasing U.S. soybeans and making contracts for future purchases, the newspaper reported. For comparison, the week of Feb.1, 2018 the United States exported about 809,000 metric tons of soybeans to China, but the week of April 26, 2018, it exported only 193,000 metric tons.

"Whatever they’re buying is non-U.S.," Soren Schroder, Bunge Ltd. chief executive officer told Bloomberg News. "They're buying beans in Canada, in Brazil, mostly Brazil, but very deliberately not buying anything from the U.S."

The Farm Bureau has already heard from pork farmers that prices have dropped considerably since the first set of Chinese tariffs. But because export data are sent on a monthly basis, Nigh said they don't have a good idea of the full impact.

Steel and aluminum impact on farms won't be immediate

While the retaliatory tariffs will likely reduce farms' income, the steel and aluminum tariffs will increase the costs to run a farm.

Imported steel will have a 25 percent tax on the current price, and domestically produced steel will raise the price to match it, according to UW-Madison professor Ian Coxhead, a development economist who specializes in globalization, growth and development in East and Southeast Asia.

The higher costs that farm equipment manufacturers incur to produce farm machinery will be passed on to the farmer who buys it, Gould said.

"If you do a search for new or used [farm] equipment, we're talking about hundreds of thousands of dollars. So it really is a big deal," Gould said. "It's not going to be a little amount [that it would go up]."

Indirectly, prices to transport agricultural products will go up because the industry that transports them will incur increased equipment costs as well, Coxhead added.

Gould explained the retaliatory tariffs on commodities could have an immediate impact, but the steel and aluminum tariffs could have a delayed impact.

"The retaliation that happened… [is] probably more significant immediately for farmers," he said.

"That's going to happen this year, but someone could put off purchasing a new combine or tractor until maybe some of those tariffs go by the wayside."

Will farms close?

It all depends on the individual farm, according to Nigh.

"I liken that to each of our individual checking accounts. How long could you go without a paycheck?," she said.

Prices were good for agricultural products in between 2011 and 2013, and farmers were able to save money, she said.

"At some point, those reserves start to run out. We have seen a small increase in bankruptcies over the last couple of years, and the longer the low prices last, the more likely it is that there would be more," Nigh said.

Smaller farms typically have proportionately more debt obligations than larger farms, and are not able to save as much during the good years. Both those factors would make them more vulnerable to prices changes in the market, Nigh explained.

"What [the tariffs] will do is [they] will reduce the profitability of farming for those markets that are impacted," Coxhead said. "So it'll accelerate the rate at which [aging farmers] will exit the industry or decide to retire or consolidate into a bigger operation. And then what they do after that, I don't know."

Eventually, those impacts will cascade through the multi-billion dollar agribusiness industry, Coxhead said. It will impact companies that transport agricultural goods, companies that store product in grain elevators and businesses that sell seeds and other supplies to farms.

"If farmers cut back production and stop buying inputs, then the whole ag economy that revolves around farmers buying stuff and selling stuff starts to get productivity levels brought down as well," Coxhead said.

Macro-economic impact

Coxhead said he believes the real fear is the possible macroeconomic impact a trading dispute could have.

"We know very, very well, and without any ambiguity, that when you have a trade war, nobody wins," he said. "So if we got to the point, which I don't think is likely, where there were real measures that restricted trade in a substantial way, then you'd start losing jobs really, really fast in the U.S."

Gould said the president's move to restrict free trade is "unprecedented" by going against 25 years of policies promoting free trade that have let countries specialize and expand their markets, but which some critics claim has come at the cost of American jobs.

Trump's move is "counter to what we've been achieving because standard economic theory says that countries are better off if they can trade, and trade in a free environment," Gould said. "Everybody wins in that situation."

The last time the world saw a global trade meltdown was in the late 1920s, a precursor to the Great Depression.

"That was set off by exactly the same kinds of rhetorical pressures and mercantilist thinking that, 'Nobody wins from trade, you only win if the other guy is losing,'" Coxhead said.

"Now that's an extreme example, no one really expects something like that to happen, but that’s where it goes," Coxhead added. "Because you can't really expect a country like China, or indeed Japan nor the E.U., not to retaliate if you impose tariffs on their exports. Of course they will."

Nigh said these tariffs could have a similar impact to the grain embargo of 1980, when the United States banned grain exports to the Soviet Union. The government heavily subsidized farms to compensate for the loss this caused, but the U.S. Department of Agriculture forecast that net farm income would drop 40 percent, according to Foreign Affairs magazine.

President Ronald Reagan made good on his campaign promise and ended the embargo in 1981.

Nigh added that if people had taken Trump’s statements at face-value, they shouldn't be surprised by his actions because he has consistently vowed to rewrite trade deals that he claims put the United States at a disadvantage.

"I think the whole country… is still trying to figure out when the president makes a statement on something how serious is he," Nigh said. "And I think we've come to learn he's pretty serious."

But Gould and Coxhead said they can't predict what Trump will do going forward, or how this dispute will end

"He seems to be all bluster," Coxhead said. "But bluster, it's hard to tell whether the bluster is sheer emotion and irrationality, or whether it's a more calculating kind of measure that's intended to achieve some goal."

Maybe, Coxhead added, the administration's secret goal is to get China to offer safeguards for intellectual property, which would be a big win. In order to do business in China, U.S. companies have reportedly been forced to turn over trade secrets and technology to Chinese companies, according to the U.S. Trade Representative.

Earlier in 2018, the office's investigation found that, "Chinese theft of American [intellectual property] currently costs between $225 billion and $600 billion annually."

"This is kind of the Trump administration style," he said. "They want to walk right up to the line and make a lot of noise and issue a lot of threats and see where that gets them."

Gould said that in the current U.S.-China dispute, politics, and not just economics, have come into play. He believes some of the president's rhetoric and policies surrounding trade, are to satisfy his political base.

"The tit-for-tat is that now China said, 'OK, you're going to put a tariff on our products, we're going to put a tariff on your products.' And the products that they're choosing aren't manufactured products, they're ag products, and obviously there's one reason they're doing that," Gould said. "The story is because rural areas are the ones that supported the president. And when you hit agricultural products, you're hitting agricultural areas, rural areas, significantly."

Gould added: "There's just a lot of political stuff going on that's motivation for this."

This trade dispute with China is only part the agriculture community's worry, Nigh said.

She added the Farm Bureau was pretty excited about opportunities under the Trans-Pacific Partnership, but Trump withdrew from that trade deal only ten days into his presidency. He has also threatened to pull out of the North American Free Trade Agreement with Canada and Mexico.

"For us, we feel we've been pretty challenged on the trade front in the past couple of years," she said. "And then you put that on top of other challenges that have led to a decrease of net farm income, and that's what's got us so nervous anymore."

It's a good thing for other countries if U.S. agricultural products become less competitive, because U.S. partners and competitors can join together for their benefit, and our expense. Nigh noted the E.U. and Mexico announced their revised free trade agreement, and it will include agricultural products, which it hadn't before.

"Even if the U.S. stops participating in trade the way we've participated recently, those [free trade agreements] are permanent," she said. "That threat continues, and that erosion of our competitive advantage continues even once our tariff activities have stopped."

Editor's note: This report was originally published on May 11, 2018 by The Observatory, a publication of the University of Wisconsin-Madison School of Journalism and Mass Communication. It is updated with information about the U.S. tariffs announced on May 29 and May 30.

This report is the copyright © of its original publisher. It is reproduced with permission by WisContext, a service of PBS Wisconsin and Wisconsin Public Radio.